Improving Payment Solutions for Small Businesses

Designing a simple, efficient payment processing solution to simplify transactions for Teamshares' network companies.

Background

Teamshares helps small businesses transition to employee ownership by acquiring businesses from retiring owners, supporting them with modern financial tools and resources, and enabling employees to become part-owners over time, fostering long-term stability and growth.

Challenge

The Financial Products team was tasked with addressing a critical gap in small businesses' ability to accept payments easily and affordably. Many of these businesses relied on paper checks, which are fraud-prone and time-consuming to process, or paid high fees for credit card processing.

Solution

We developed a payment processing feature using Stripe, allowing businesses to create customized payment pages for one-time or recurring payments.

Process

I conducted research with financial leaders at our network companies to learn more about their roles and responsibilities related to accepting payments. Some key insights included:

Financial leaders wore many hats (e.g., bookkeeping, payroll, compliance), so the solution needed to be simple and efficient.

Customers of these businesses had varying technical skills, especially in industries like auto repair and refrigeration, requiring a highly intuitive and user-friendly design.

Based on these insights, we made the following design decisions:

Streamline onboarding: To simplify adoption, we used a neutral default template for payment pages, allowing only light customization (e.g., logos) to maintain trust and branding.

Prioritize flexibility: Given the range of use-cases of our network companies, we included key customization options such as the ability to choose between single use and multiple use links, and fixed and flexible amounts. This covered the majority of use cases, while keeping the UX simple.

Outcome

The project was scoped for a 6-week timeline to minimize costs. Our user research allowed us to keep scope to a minimum, while giving us confident that what we shipped met our customers basic needs. Since launch, numerous companies have successfully onboarded, and many are transitioning customers from checks and costly credit card fees to this streamlined solution.

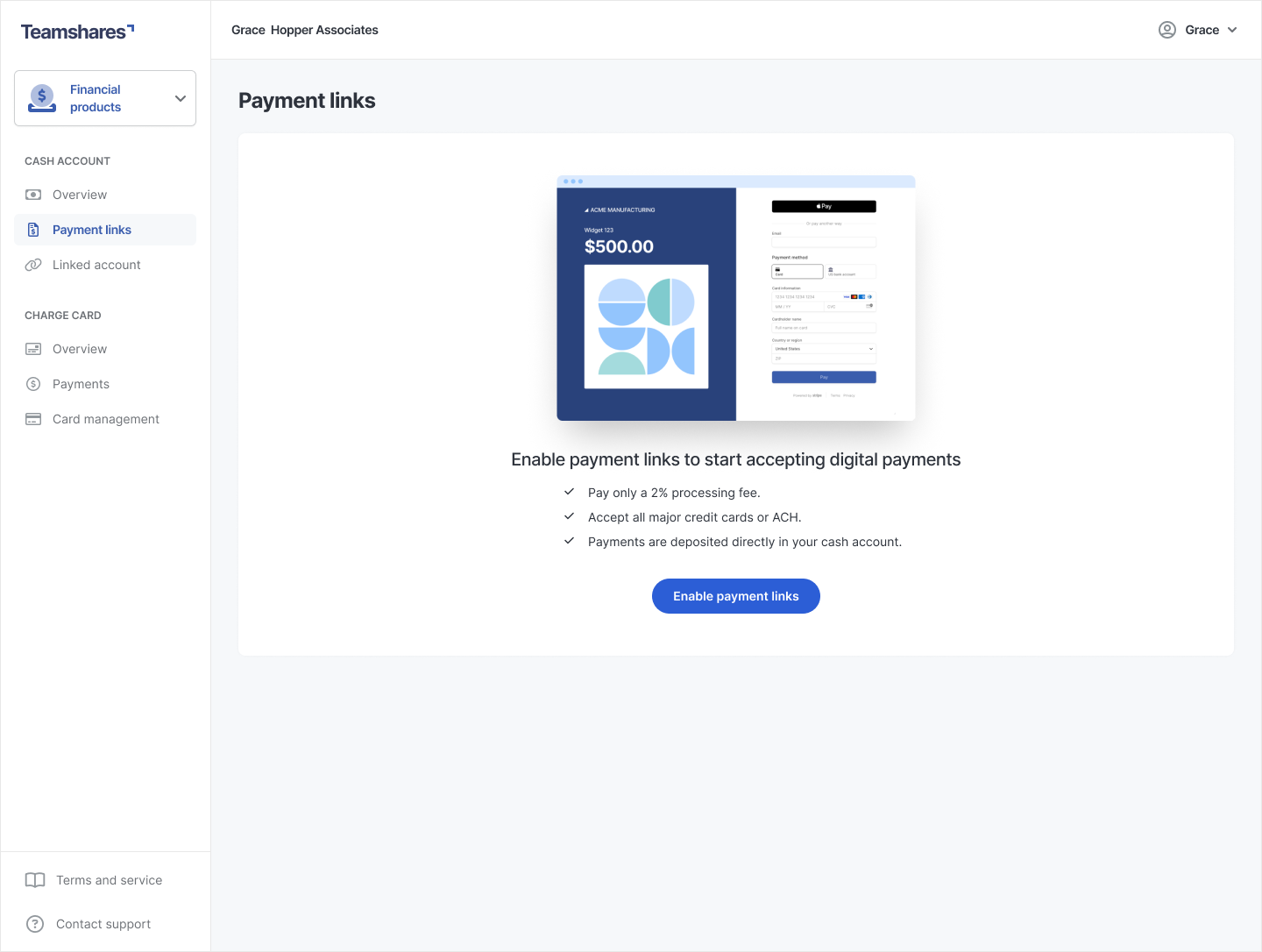

Marketing page for a new Payment Link feature, explaining the benefits to network companies.

Onboarding step where companies could add their company name and logo.

Payment Link creation page where users could customize individual payment links.

Company view where admins can manage payment links and view for individual links.

Example of a payment link page network companies could use to collect payments.